Revenue growth management drives sustainable, profitable growth. It is a shift in thinking. Instead of chasing more sales at any cost, you make smarter decisions. You learn how to price, package, and sell products to the right customers.

What Is Revenue Growth Management and Why It Matters Now

Picture a local shop owner. They could boost revenue by ordering more stock and hoping it sells. Or, they could take a measured approach. They could analyze which products are most popular. They could find which promotions bring in loyal shoppers without hurting profits. They could strategically place items to encourage customers to buy more.

That second approach is the heart of revenue growth management (RGM). It moves away from a volume-based mindset. It prioritizes the quality and profitability of each transaction. The core question changes from, "How can we sell more?" to "How can we generate more profitable revenue from the customers and products we have?"

This strategic shift is crucial when the economy is uncertain. Take Brazil's B2B SaaS market. With GDP growth expected to slow from 3.4% in 2024 to 2.2% in 2025, revenue leaders cannot be inefficient. They need precise strategies like RGM to protect their margins and grow smartly. You can dig deeper into Brazil's economic outlook on BBVA Research.

The Core Levers of RGM

How do you put RGM into practice? You pull four main levers. Think of them as the pillars of your growth strategy. They work together. They create a unified plan that keeps your sales, marketing, and finance teams aligned.

Understanding these components is the first step. Each one targets a specific part of how your business makes money.

Here is a simple breakdown of the four foundational pillars of an RGM strategy.

Pillar | Core Objective | Example Activity |

|---|---|---|

Pricing Strategy | Set prices based on value, not cost. | Analyze customer segments to create tiered pricing that reflects the value each group receives. |

Promotion Optimisation | Ensure discounts and offers drive profitable growth. | A/B test promotional offers to find which one delivers the highest ROI, instead of using blanket discounts. |

Portfolio & Packaging | Offer the right product mix to the right customers. | Create new product bundles that combine high-demand features with lesser-used ones to increase average deal size. |

Performance Management | Use data to measure what works and refine your approach. | Build a dashboard to track net revenue retention and pricing realization after a price change. |

These pillars are not a checklist. They are interconnected parts of a system designed to maximize revenue potential without sacrificing profitability.

Revenue growth management is not a one-off project; it is a continuous, data-driven cycle. It requires collaboration between sales, finance, marketing, and product teams. This aligns commercial strategies with financial goals. By focusing on these core levers, companies can build a resilient and powerful growth engine.

The Five Strategic Levers of Modern RGM

Getting Revenue Growth Management right means moving from theory to action. RGM is about pulling five distinct, yet connected, strategic levers. Each one offers a different way to influence how your company captures value. This ensures growth is both profitable and sustainable.

Think of it like piloting an aircraft. You have multiple controls. Each has a specific job, but you must use them together to reach your destination. If you focus too much on one control, your strategy will go off course.

1. Strategic Pricing

Pricing is the most direct lever for impacting revenue. Strategic pricing is not about guesswork or simply raising prices. It is a shift from cost-plus or competitor-based models to value-based pricing. Your price should reflect the tangible value and return on investment your customer receives.

To make this switch, you must understand your customers' willingness to pay. This means quantifying the problems you solve. Align your pricing tiers to the different levels of value you deliver. For example, a basic plan might solve one specific pain point. A premium tier could tackle complex, business-wide challenges.

Use this checklist to assess your pricing strategy:

Customer Segments: Do our pricing tiers map to distinct customer groups based on their needs and perceived value?

Value Quantification: Can our sales team explain the monetary value our product delivers in time saved, revenue gained, or costs cut?

Discounting Discipline: Are discounts a strategic tool for landing key accounts, or a default tactic that erodes profits?

2. Portfolio and Packaging Optimisation

How you bundle and present your products is another powerful lever. This is about creating offers that appeal to customers and are engineered to maximize revenue. The goal is to design tiers, bundles, and add-ons that guide customers toward the best solution for them.

A common mistake is overwhelming customers with confusing packages. This often leads to no choice at all. A smarter approach is to analyze usage data and customer feedback. Find out which features truly matter. These insights help you build logical packages that make upgrading feel like the natural next step.

A well-packaged portfolio sells outcomes, not just features. Each tier should represent a clear step up in capability and value, making the upsell path feel natural.

Imagine a software company discovers that users who adopt a specific reporting feature are 30% less likely to churn. With that data, they could move that feature from a standalone add-on into their mid-tier package. This not only improves retention but also provides a solid justification for that tier's price.

3. Go-to-Market Motions

Your go-to-market (GTM) motion is how you deliver your product to customers. A sharp RGM strategy recognizes that a one-size-fits-all approach is inefficient. Different customer types require different sales methods to be profitable.

For instance, a low-cost, high-volume product fits a self-service or product-led growth (PLG) motion. The product sells itself. In contrast, a complex, high-ticket enterprise solution needs a dedicated, high-touch sales team. The key is aligning the cost of your sales effort with the customer's potential lifetime value. You can dive deeper into these strategies in our guide to inbound vs. outbound sales motions.

Assess your GTM alignment with these questions:

Product-Led Growth (PLG): Is our product intuitive enough for users to see value without talking to a salesperson?

Inside Sales: Are we set up to sell effectively to mid-market customers with remote teams?

Enterprise Sales: Do we have a specialized team ready for the long, complex sales cycles of high-value deals?

4. Channel Mix Management

Managing your sales channels is closely related to your GTM. The right mix depends on your product, target market, and growth stage. The objective is to identify the most efficient and profitable paths to your customers.

Your channels might include a direct sales force, partnerships with resellers, or online marketplaces. Each channel has its own cost structure, reach, and customer profile. Strong RGM discipline involves constantly analyzing channel performance. You must be ruthless about reallocating resources to the channels that deliver the best return.

5. Customer Segmentation

Everything comes back to this. All other levers depend on a sophisticated approach to customer segmentation. Often, segmentation stops at basic firmographics like company size or industry. Modern RGM goes deeper. It groups customers based on their behavior and the value they get from your product.

This is known as value-based segmentation. You group customers by the outcomes they want to achieve. For example, one segment might use your software to boost internal efficiency. Another might use it to drive top-line revenue growth. These two groups respond to different messaging, care about different features, and have different ideas of a fair price. Understanding this allows you to tailor your pricing, packaging, and sales approach for maximum impact.

Building Your RGM Implementation Roadmap

Implementing a Revenue Growth Management function does not happen overnight. It is a journey that demands a structured, phased approach. This builds momentum, proves value, and gets company-wide buy-in. A practical roadmap breaks the process into manageable steps. You focus on getting the foundation right before you scale.

This deliberate process ensures every move is backed by data and tied to business goals. It prevents RGM from becoming another corporate project that fizzles out. You begin with your data, run a controlled test, and then expand based on proven results.

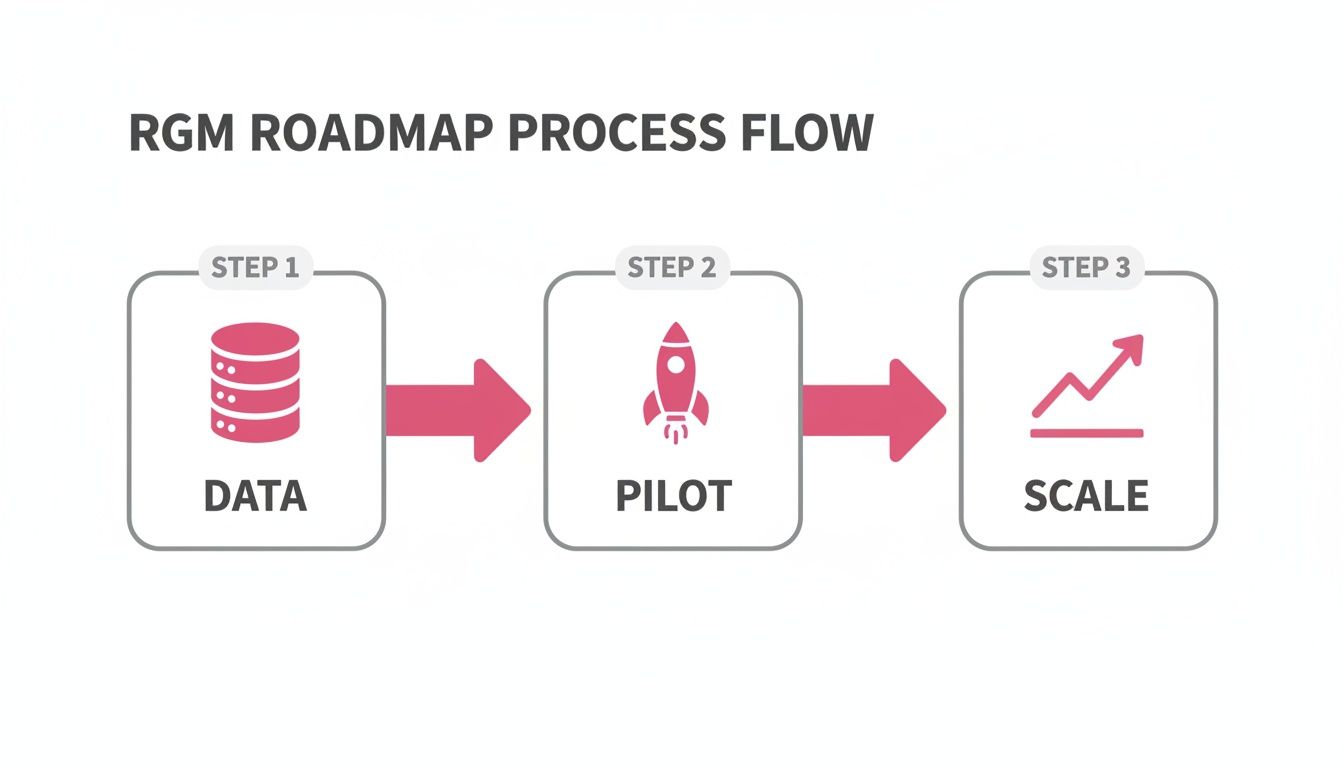

The process flow below outlines the three essential phases for launching RGM successfully.

A solid roadmap moves logically. It starts with data gathering, moves to a focused pilot, and finishes by scaling proven strategies across the business.

Phase 1: Foundational Data and Alignment

Before making strategic calls, you need trustworthy data. This first phase is about gathering the right information. It also involves getting key players aligned. Your CRM is central, but critical data also resides in finance and product systems.

The goal is to build a single source of truth for your revenue, pricing, and customer behavior. This is a team effort.

Early buy-in from leaders in sales, finance, and product is non-negotiable. RGM is a team sport. Successful implementation depends on cross-functional alignment from day one.

Once you consolidate the data, agree on the problems you are trying to solve. What are your most urgent revenue challenges? Perhaps margins are squeezed by excessive discounting. Maybe there is low adoption of a premium product tier. Or you might struggle to spot upsell opportunities. Aligning on these priorities ensures your efforts will make the biggest impact.

Phase 2: Pilot Programme and Quick Wins

With a solid data foundation and clear goals, it is time to launch a pilot program. A common mistake is trying to roll out RGM company-wide from the start. This is a recipe for failure. Instead, pick a specific area to test your ideas and show value quickly.

A pilot could focus on:

A specific product line where you suspect the price does not match the value.

A single customer segment that receives heavy discounts.

One sales team or region to test new discounting rules.

Define what success looks like for the pilot. For example, you might aim to increase the average selling price by 5% for one product. Or you could aim to cut the overall discount rate by 10% in a single quarter. These measurable goals are crucial for proving the pilot worked and making the case to expand.

Phase 3: Scaling and Technology Integration

After a successful pilot delivers clear results, you have the proof you need to scale. This phase is about rolling out proven processes to the rest of the company. It is also when technology becomes essential.

As you scale, manual data analysis is no longer feasible. Tools that deliver real-time customer insights become vital. For instance, Brazil's RGM challenges intensified in 2025 as high borrowing costs reshaped B2B sales funnels. Sales ops teams used automation to extract customer promises from calls. This boosted expansion revenue by 18%. B2B teams that adopt this tech outperform peers by 22% in revenue retention during slowdowns.

Platforms like Samskit use conversation intelligence to analyze sales calls automatically. They pinpoint reasons for pricing objections or feature requests. This turns unstructured conversations into clean data that fuels your RGM decisions at scale. To learn more about choosing tools, you might find our guide on prospecting with similar tech helpful.

Pushback is a common hurdle during this phase. Handle this change with clear communication, ongoing training, and by sharing data-driven proof from your successful pilot.

The Data and Technology That Power RGM

Any revenue growth management strategy is only as strong as its underlying data. You cannot execute effective RGM without a solid tech stack. The right technology provides clean data and reveals what that data means. The goal is to build a connected system where information flows freely. This turns raw customer interactions into sharp, strategic decisions.

This is not about buying every new tool. It is about deliberately integrating a few core technologies. This creates a workflow that supports your RGM goals.

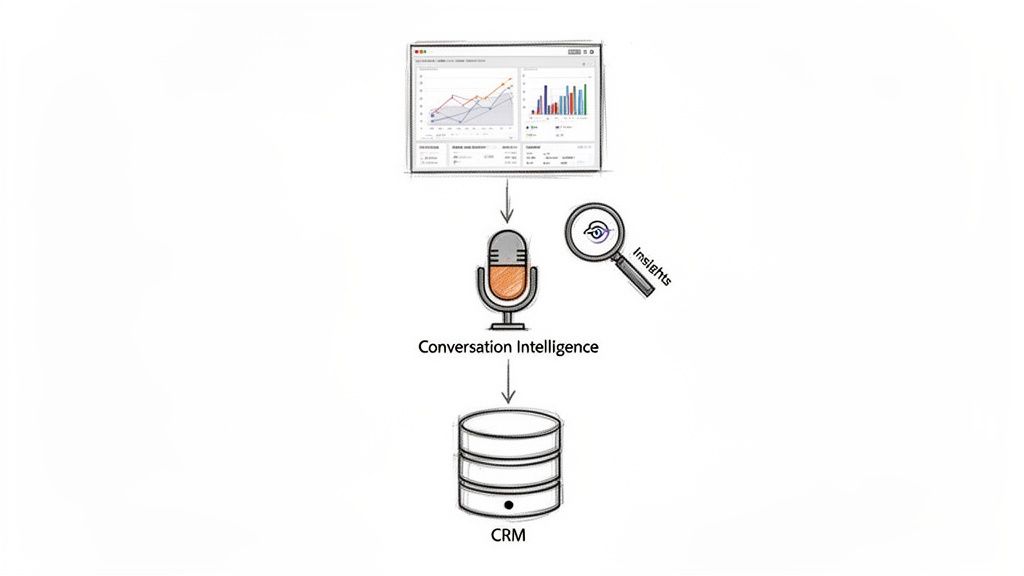

Think of it this way: raw data from customer calls is captured and analyzed. It is transformed into structured insights that update your CRM. This creates a powerful feedback loop for constant improvement.

This is the ideal state—a system that gets smarter with every conversation.

The CRM as the Source of Truth

Your Customer Relationship Management (CRM) platform must be the undisputed source of truth. It is the central hub for all customer data, deal stages, and interaction history. If your CRM data is messy, any RGM initiative is built on shaky ground.

To get this right, enforce strict data hygiene. Use automation to reduce human error from manual entry. You need to trust that the data in your CRM accurately reflects your pipeline, segments, and performance. This data is the raw material for every RGM analysis you will run.

Conversation Intelligence Platforms

Your CRM holds structured data—the "what." Your team's conversations with customers contain unstructured insights—the "why." This is where conversation intelligence (CI) platforms like Samskit play a crucial role.

These tools record, transcribe, and analyze calls and meetings. They automatically extract valuable RGM data that would otherwise be lost.

Conversation intelligence turns unstructured talk into structured data. It systematically identifies customer objections to pricing, mentions of competitor packaging, feature requests, and buying signals. This provides ground-truth data for strategic decisions.

Imagine your CI tool flagging every call where a competitor's new pricing is mentioned. Suddenly, you have quantitative evidence. This helps you decide if you need to adjust your own packaging and promotions.

BI and Analytics Tools

The final piece is your Business Intelligence (BI) and analytics tool. This is where you bring everything together. You connect data from your CRM, CI platform, and other sources to see the complete picture. These tools visualize RGM performance and help you spot trends.

The practical application is what matters. You can build a dashboard that cross-references call insights with CRM data to answer critical questions:

Is our new pricing working? Track mentions of a new package in sales calls. This lets you gauge real-time customer reactions and pinpoint objections.

Is our promotion driving the right behavior? Analyze whether a discount leads to faster closes or just attracts lower-value customers.

Where are our best upsell opportunities? Identify frequent feature requests from your most valuable customer segment. This builds a data-backed case for new product development.

A connected tech stack ensures your RGM strategy is not based on guesswork. It is fueled by a constant stream of real-world customer data. To dig deeper into optimizing these workflows, check out our guide on the role of a CRM in inside sales.

RGM in Action: Real-World Scenarios

Theory is one thing. Seeing how Revenue Growth Management works in the real world makes it click. These scenarios show how B2B SaaS companies use RGM to solve tough revenue problems. They use genuine customer insights to drive their actions.

Let's walk through three common situations where an RGM strategy turns a business problem into a profitable win.

Scenario 1: The Underperforming Product Bundle

A SaaS company was puzzled. Adoption of its premium software tier was flat. The package had advanced features, but sales data showed it was not selling. Reps kept falling back to lower-priced plans. The easy assumption was that the price was too high.

But their sales call transcripts told a different story. Customers were not objecting to the price itself. They were confused about the value of one specific feature in the bundle. They did not understand what it did or why they needed it. This made the entire premium package seem overpriced.

The RGM Action Plan:

Instead of a knee-jerk price cut, they used a surgical approach.

Unbundle the Feature: First, they removed the misunderstood feature from the premium tier.

Create a Paid Add-on: Next, they repackaged it as a standalone, paid add-on with a clear value proposition.

Adjust Premium Tier Price: Finally, they lowered the price of the leaner premium tier to align with its new feature set.

The impact was immediate. The premium tier became a more logical and appealing upgrade. The company also created a new, high-margin revenue stream from power users who wanted the add-on's functionality. They turned a product weakness into a strength.

Scenario 2: Discounting Gone Wild

A mid-market tech firm's sales team had a bad habit. They gave away discounts to get deals done, especially at quarter-end. This was crushing their profit margins. Leadership knew it had to stop.

The challenge was clear: rein in discounting without hurting the sales team's ability to close. The RevOps team decided to find the "why" behind each discount. Using conversation intelligence to analyze call data, they found a startling fact. Only 30% of customers who received a discount had raised a serious price objection. The other 70% were given a discount as part of the standard sales process.

You cannot manage what you do not measure. By understanding the real reasons for discounting, the RevOps team could shift from a blunt policy to a data-driven strategy that protected margins.

The RGM Action Plan:

With this data, RevOps built a smarter framework.

Implement a Discount Matrix: They developed a clear approval system. Discounts were pre-approved for specific, price-sensitive customer segments. They required manager sign-off for segments that historical data showed would buy without one.

Provide Data-Driven Coaching: Sales managers used call recordings to coach reps. They taught them how to respond to price concerns with value-based arguments instead of offering a discount.

This data-informed approach cut the company's average discount rate by 15% in two quarters. This directly boosted the bottom line.

Scenario 3: Pinpointing an Expansion Opportunity

Account managers struggled to hit their expansion revenue targets. They were unsure how to start upsell or cross-sell conversations. Most of their efforts were shots in the dark. The product roadmap was full, but no one knew which new features would convince customers to spend more.

The company decided to listen at scale. They analyzed thousands of hours of customer success calls and business reviews. They spotted a pattern. Customers in their largest segment consistently asked for the same workflow improvement: a feature to automate a tedious manual process.

This was not a minor feature request. It was a clear signal of unmet demand from their most valuable customers.

The RGM Action Plan:

This insight became the seed for a major growth initiative.

Develop a New Module: The product team used the call transcripts as a business case. They fast-tracked development of a new, paid module that solved the exact problem.

Create a Targeted Campaign: Marketing and sales built a campaign aimed at the customer segment that had asked for the solution.

The new module quickly became one of the company's most successful upsells. It created a new expansion revenue stream built directly from the voice of the customer.

Here is a quick look at how these challenges and solutions fit into a broader RGM framework.

RGM Problem and Solution Examples

Business Challenge | Data Source for Insight | Practical RGM Solution |

|---|---|---|

Low adoption of a high-tier product. | Sales call transcripts reveal confusion over one feature's value, not price. | Unbundle the feature into a paid add-on and reduce the main bundle's price. |

Excessive, margin-eroding discounting. | Conversation intelligence shows 70% of discounts are offered without a customer objection. | Implement a data-driven discount approval matrix and coach reps on value-selling. |

Stagnant expansion revenue. | Customer success call analysis identifies a consistent request for a specific feature. | Build a new, paid module addressing that need and launch a targeted campaign. |

Rising customer acquisition costs. | Segmentation data reveals an underserved but highly profitable niche. | Develop a new GTM motion and pricing package for that high-value niche. |

These examples highlight a core principle. The answers to your biggest revenue challenges are often hidden in your customer conversations and data.

Measuring Success: Key Metrics for RGM

An RGM strategy is just a theory until you can prove it works. To do that, you must look beyond headline revenue. Dig into the numbers that signal sustainable growth. Are you becoming more profitable, or just selling more for less?

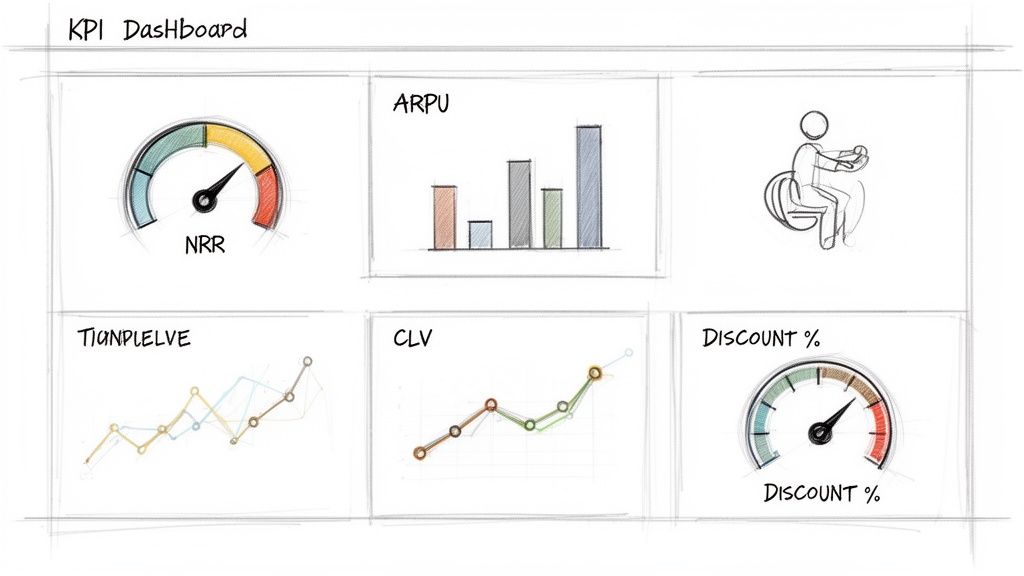

Think of your key metrics as instruments on a dashboard. They tell you if your pricing, packaging, and sales motions are creating real value or just empty volume. Without them, you are flying blind.

Core Metrics for Your RGM Dashboard

Start by tracking a few core metrics. These give you an unfiltered look at the health of your revenue engine.

Net Revenue Retention (NRR): This is the acid test for customer value. NRR shows the revenue you kept and grew from existing customers. It factors in upsells, downgrades, and churn. An NRR above 100% is the goal. It means your existing customer base is expanding.

Average Revenue Per User/Account (ARPU/ARPA): This metric tracks the average revenue from each customer. Monitoring ARPU shows if your pricing and packaging changes are increasing deal value.

Customer Lifetime Value (CLV): CLV predicts the total revenue you can expect from a customer over the entire relationship. It helps identify your most profitable segments. This tells you where to focus your sales and marketing efforts.

Discounting Percentage: This simple metric measures the average discount your team gives to close deals. It reflects your pricing integrity. A high percentage often means reps are selling on price, not value.

A strong RGM strategy consistently improves these metrics. The goal is not just to make numbers go up. It is to build a more profitable and predictable revenue stream from the customers you already have.

Putting Metrics into Practice

Knowing which metrics to track is one thing. Using them to make decisions is another. Your dashboard should be a central point of discussion for sales, finance, and product leaders.

For instance, if your ARPA is flat while your discounting percentage is climbing, that is a red flag. It signals your sales team may need more coaching on selling value. If NRR starts to dip, it might be time to analyze customer success calls to understand the cause of churn.

This data-first mindset removes guesswork from your strategy. It turns revenue growth management from a vague idea into a practical, measurable discipline that drives profitable growth.

Got Questions About Revenue Growth Management?

Diving into Revenue Growth Management can bring up questions. Here are some common ones, with straightforward answers.

Is This a "Big Company Only" Game?

No. The core ideas are just as powerful for B2B SaaS businesses of any size.

For a startup, RGM might mean setting prices for your first product tiers. It could involve analyzing early customer feedback. For a scale-up, it could be key to unlocking expansion revenue from existing customers. The trick is to start with the data you have. Aim for small, smart changes that lead to profitable growth.

How Is This Different from Sales Ops?

This is a common point of confusion. Sales Operations focuses on making the sales machine run smoothly. Think territory planning, CRM management, and streamlining daily sales processes.

Revenue Growth Management takes a broader, strategic view. It pulls data from sales, marketing, finance, and product. It answers big questions: where should we compete (which segments and channels are most profitable?) and how do we win (what is the optimal pricing, packaging, and promotion strategy?). While RevOps often executes the RGM plan, the scope of RGM is wider. It directly shapes company-wide strategy.

Think of it this way: Sales Ops is the mechanic keeping the engine tuned. RGM is the GPS, charting the fastest, most profitable course.

How Can We Start with a Small Team and Limited Resources?

You do not need a large team to start. Pick one high-impact area and build from there. A great first step is to examine your pricing and discounting habits.

Start by digging into your CRM data. Find which customer segments get the biggest discounts. That is your starting point. Next, use a conversation intelligence platform to listen to sales calls for those deals. What is being said? Are customers pointing out feature gaps? Are competitors mentioned often? Or has discounting just become a habit?

With those insights, you can run a small, controlled experiment. For example, create a new discounting guideline. Roll it out to just one sales team. Track the impact on your profit margins and win rates. This "start small, prove value" approach is the best way to get quick wins and build momentum for your RGM efforts.

Samskit is a sales assistant that turns customer meetings into reliable CRM updates and clear next steps. By automatically analysing sales calls, it surfaces the pricing objections, competitor mentions, and feature requests you need to fuel a smarter revenue growth management strategy. Learn more at https://samskit.com.