In B2B sales, you have likely heard of the MEDDIC sales methodology. It is a qualification framework that helps sales teams win complex deals. Think of it as a checklist. It confirms you have secured every critical piece of an opportunity. This stops you from wasting time on deals that will not close.

What Is the MEDDIC Sales Methodology?

MEDDIC offers a structured way to qualify complex sales opportunities. A company called PTC developed it in the 1990s. They needed to make their sales process more predictable. This was especially true for large enterprise deals with long sales cycles and many stakeholders.

Picture it as a pilot's pre-flight checklist.

Before a pilot takes off, they check every critical system—fuel, weather, controls. This ensures a successful flight. MEDDIC gives a salesperson the same systematic process. It provides a checklist to validate every essential part of a deal before committing resources.

The Core Principle Behind MEDDIC

The framework forces you to stop relying on assumptions. Instead, you build your sales strategy on hard evidence from the prospect. By demanding proof for each of its six components, MEDDIC pushes you to gain a deep, factual understanding of a deal's status. It changes the conversation from a generic product pitch to a focused qualification dialogue.

Teams that adopt MEDDIC aim for specific results:

Improve Forecast Accuracy: Qualifying deals on objective facts makes sales forecasts more reliable.

Increase Win Rates: Your team focuses energy and resources on winnable opportunities, not a pipeline full of dead ends.

Shorten Sales Cycles: A clear map of the buyer's internal process helps you anticipate roadblocks and keep the deal moving.

MEDDIC creates a discipline that helps sales organizations systematically find and close key deals. It establishes a common language for pipeline health. This ensures everyone, from a new account executive to the CRO, agrees on what a "qualified opportunity" is. This is not about process for its own sake. It is about building a scalable sales engine for tough B2B environments.

Breaking Down the MEDDIC Framework, Element by Element

MEDDIC is a practical toolkit for dissecting a deal. Think of it as a checklist for understanding what is happening inside a potential customer's organization. Each letter represents a crucial area of discovery you must master to qualify opportunities and control the sale.

Let's unpack each element with practical examples.

M Is for Metrics

This element is about the numbers. Metrics are the tangible, measurable results a client expects after your solution is in place. Your job is to shift the conversation from vague promises like "better efficiency" toward concrete outcomes like, "a 15% reduction in production costs within six months."

Without solid metrics, you are just selling a product. With them, you are selling a measurable business outcome. To get there, your reps must ask questions that push the prospect to think in numbers.

Checklist: Uncovering Metrics

Ask: "What does success for this project look like in numbers?"

Ask: "How will your manager measure its impact?"

Ask: "What is the financial impact on revenue, costs, or risk if we solve this?"

Ask: "What ROI does your finance team require to approve a new investment?"

Nailing down metrics early builds your entire business case. It becomes the "why" behind the deal, grounded in the financial language executives understand.

E Is for Economic Buyer

The Economic Buyer is the single person who controls the budget and has the final authority to approve the deal. This is not always the CEO or your day-to-day contact. It is the individual with profit and loss (P&L) responsibility for the area your solution impacts.

Finding this person is non-negotiable. The sooner, the better. Everyone else on the buying committee can say no, but only the Economic Buyer can give a definitive yes.

Your deal is at risk until you identify, meet, and align with the Economic Buyer’s strategic goals. They hold the ultimate veto power.

The goal is to get a meeting with this person. A good Champion can help, but your team must be ready to speak their language. This means discussing high-level business objectives, not just product features. Your team's ability to map an organization's power structure is a critical skill here. You can learn more about refining your outreach in our guide on sales prospecting.

D Is for Decision Criteria

Decision Criteria are the specific standards the company will use to evaluate you against competitors. It is the formal (or informal) checklist they use to assess their options. If you do not know what is on that list, you are flying blind.

These criteria usually fall into three buckets:

Technical Criteria: Does it integrate with our current tech stack? Does it meet our security standards?

Financial Criteria: What is the total cost of ownership? Does the pricing fit our budget cycles? What is the expected ROI?

Vendor Criteria: Do they prefer established players or new innovators? What level of support do they need?

When you uncover these criteria, you can shape your proposal around what matters to them. If they do not have a formal list, you have an opportunity to influence it and set standards that highlight your strengths.

D Is for Decision Process

Decision Criteria cover what the buyer looks for. The Decision Process covers how they will make the purchase. It is the step-by-step roadmap from their initial evaluation to a signed contract.

Mapping this process is essential for accurate forecasting. You need to know:

The Steps: What are the key stages? Is there a technical review, a legal review, a procurement process?

The People: Who is involved at each stage, and what is their role?

The Timeline: When will each stage happen?

A simple question like, "Can you walk me through the steps your team took the last time you bought a similar solution?" can reveal the entire blueprint. This knowledge helps you spot potential roadblocks and proactively keep the deal on track.

I Is for Identify Pain

Pain is the engine that drives every B2B purchase. Without a significant, urgent business problem, there is no compelling reason for a company to change and spend money. Your job is to find that pain and assign a dollar value to it.

This means digging deeper than surface-level issues. A slow reporting process is an inconvenience. The fact that this slow process causes the company to miss market opportunities and lose €2 million in potential revenue? That is real, quantifiable pain. The goal is to draw a direct line from the problem to a painful business consequence.

Example: Quantifying Pain

Surface Pain: "Our customer onboarding is too slow."

Quantified Pain: "Slow onboarding creates a 30-day delay in revenue recognition for new clients, costing us $250k per quarter and leading to a 10% higher churn rate in the first year."

C Is for Champion

A Champion is your internal advocate. This is someone inside the prospect’s company who is personally invested in your success because they believe your solution will solve their problem. They are not just a friendly contact; they are the one selling for you when you are not in the room.

A true Champion has three key traits:

Power and Influence: They are respected and can get you meetings with key people, including the Economic Buyer.

Personal Pain: The business problem you solve directly affects them and their job.

Active Support: They give you insider information, fight for you in meetings, and help you navigate internal politics.

To know if you have a real Champion, test them. Ask for a small action, like an introduction to another stakeholder. A true Champion will deliver. Building this relationship is often the single most important factor in winning a complex B22B deal.

The MEDDIC Framework at a Glance

This quick-reference table summarizes each component of the MEDDIC framework. Use it as a checklist to qualify any deal.

Component | What It Means | Key Questions to Uncover |

|---|---|---|

Metrics | The quantifiable economic benefits and ROI. | "What specific KPIs are you hoping to improve?" |

Economic Buyer | The individual with ultimate budget authority. | "Who holds the final sign-off for an investment of this size?" |

Decision Criteria | The standards the buyer uses to evaluate solutions. | "What are the three most important factors in your decision?" |

Decision Process | The steps, people, and timeline for the purchase. | "Can you outline the approval process from here to a signed contract?" |

Identify Pain | The urgent business problem driving the need. | "What happens if this problem isn't solved in the next quarter?" |

Champion | Your internal advocate who sells on your behalf. | "Who in your organisation is most impacted by this and would benefit most?" |

By consistently asking these questions, your sales team can move from hopeful guessing to confident, data-backed forecasting.

When to Use the MEDDPICC Variation

MEDDIC is a solid framework for complex sales, but some deals are even more complicated. That is where MEDDPICC comes in. It adds two extra layers of scrutiny for massive enterprise deals.

The two extra letters—P for Paper Process and C for Competition—are your insurance policy. They address two blind spots where solid-looking deals often fail: bureaucratic red tape and surprise competitors.

Using MEDDPICC is a strategic shift for sales cycles that are exceptionally long, have a high price tag, and face significant internal and external pressure.

P is for Paper Process

The first "P" stands for Paper Process. This is different from the Decision Process. The Decision Process tells you who needs to say yes. The Paper Process tells you how the actual contract gets signed.

It forces you to get specific on the journey from a verbal "yes" to a signed agreement. You start asking practical questions.

Are we using their contract template or ours?

What are the non-negotiable clauses their legal team always includes?

Who in security, compliance, or data privacy must approve this?

Deals can get stuck in legal review for months because no one mapped this out. By investigating the Paper Process early, you can anticipate roadblocks, prepare documents, and work with your Champion to speed things along. It stops your deal from stalling at the finish line.

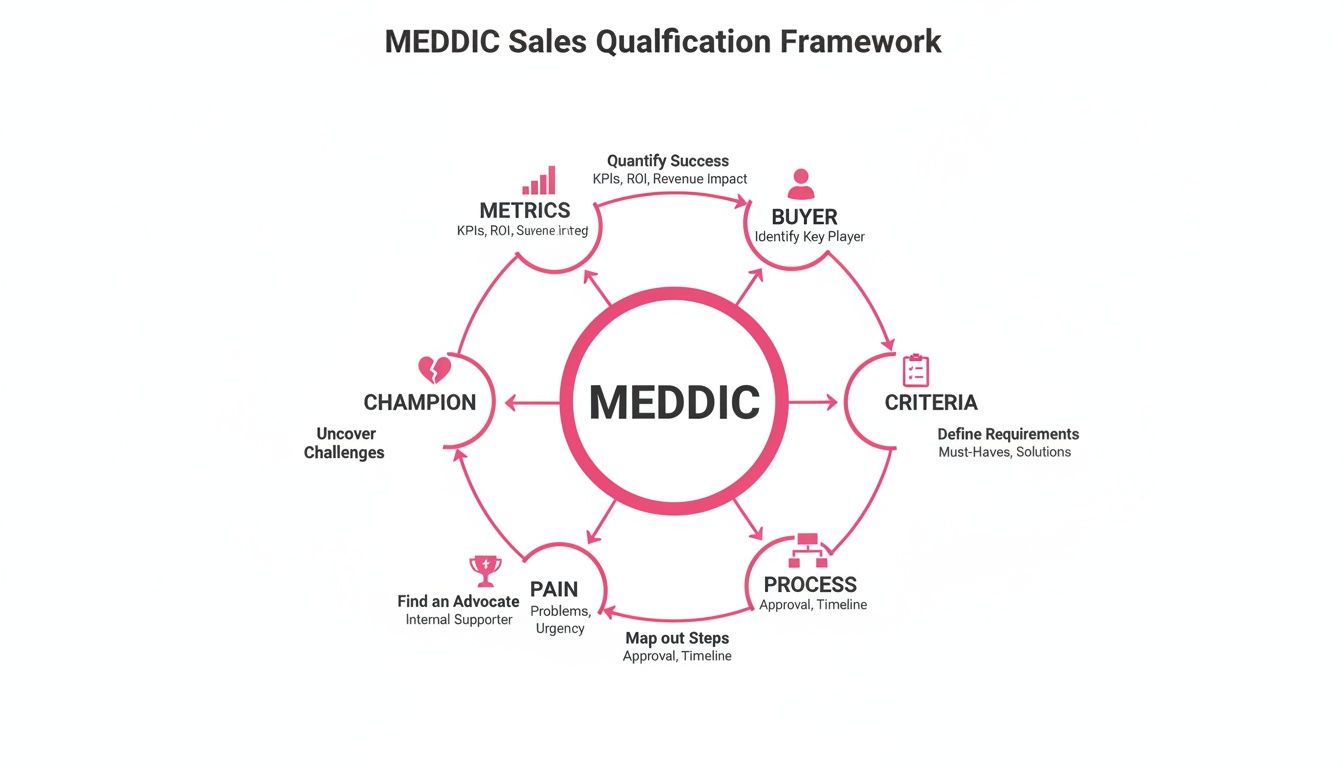

The diagram below shows the foundational MEDDIC framework that MEDDPICC expands upon.

Each of these six original elements informs the others, creating a complete picture of your deal's health.

C is for Competition

The final "C" forces a hard look at the Competition. "Competition" is not just other vendors. It is any alternative your buyer is considering.

You are usually up against three threats:

Direct Competitors: Other companies with a similar offering.

Internal Alternatives: The risk that they will decide to build a solution themselves.

The Status Quo: The decision to do nothing, which is often the most dangerous competitor.

Forgetting that "doing nothing" is an option is a huge mistake. If the pain is not urgent, sticking with the current situation is always the easiest choice for a buyer.

When you add Competition to your qualification checklist, you must think like a strategist. You need to understand your rival's position from the customer's point of view. You must equip your Champion to advocate for you. You are no longer just selling your solution; you are actively selling against every other choice.

How to Bring MEDDIC into Your Sales Process

Knowing MEDDIC and making it a habit for your sales team are two different things. To implement it correctly, you must move MEDDIC from a concept into a daily discipline. This requires a structured approach, not a one-off training session.

The goal is to embed MEDDIC so deeply that it becomes the default language for deal reviews, pipeline discussions, and forecasting. This change requires a clear plan, consistent reinforcement, and the right tools.

Step 1: Start with Hands-On Training Workshops

Everything begins with foundational training. This should be an interactive workshop focused on practical application. Your team needs to understand not just what each letter means, but how to find that information in a real conversation.

A good workshop should include:

Role-Playing Scenarios: Conduct mock discovery calls where reps must identify Metrics, find the Economic Buyer, and test for a Champion.

Real Deal Breakdowns: Take a current deal from your pipeline and analyze it as a group using the MEDDIC framework. This makes the concept immediately relevant.

Question Crafting: Brainstorm the specific, open-ended questions reps can use to uncover each element of MEDDIC. Document and share them.

This initial training ensures everyone is on the same page and using the same language. It is the first step toward building a MEDDIC-driven sales culture.

Step 2: Integrate MEDDIC into Your CRM

For MEDDIC to become a habit, it must live in your CRM. If qualification details are stuck in notebooks, they are useless for coaching and forecasting. You must build the framework directly into your sales workflow.

Start by creating custom fields in your CRM (like Salesforce or HubSpot) for each letter of MEDDIC on your Opportunity records.

Make these fields mandatory before a deal can advance to the next stage. This simple rule forces reps to qualify opportunities properly before they impact the forecast.

This action transforms your CRM from a simple database into an active qualification tool. Managers get a consistent, at-a-glance view of deal health based on evidence, not a rep’s intuition. A structured process helps inside sales reps focus their efforts effectively.

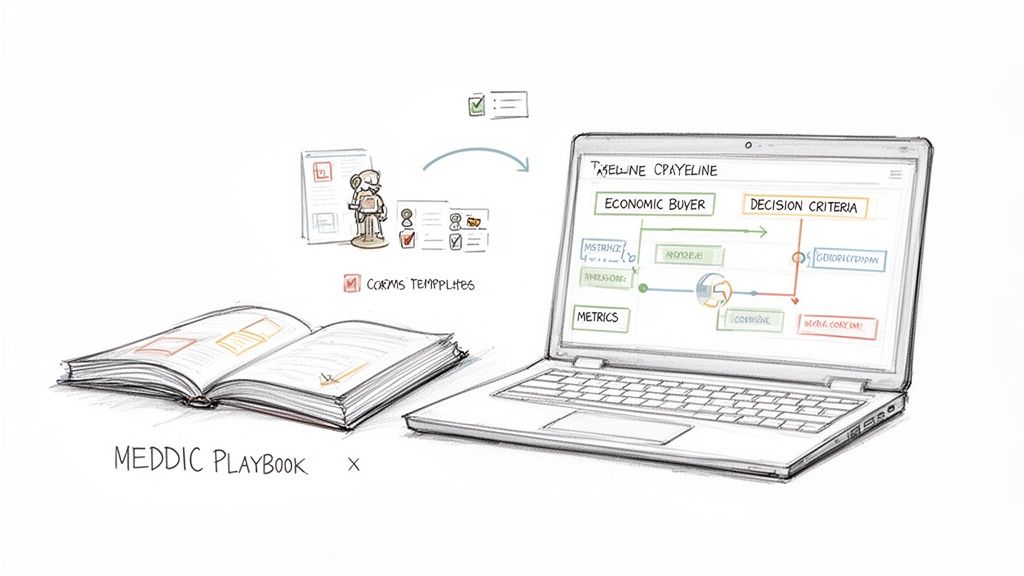

Step 3: Build a Practical MEDDIC Sales Playbook

A playbook is your team's single source of truth for applying MEDDIC. It should contain templates, checklists, and guides. Think of it as a living document that improves as your team learns.

A MEDDIC playbook should contain:

Opportunity Qualification Template: A simple, one-page guide for each deal. Reps fill this out to map their discovery and strategy.

Champion Validation Checklist: A list of criteria to distinguish a true Champion from a friendly contact. For example: "Has your contact introduced you to the Economic Buyer?"

Deal Review Questions: A standard set of MEDDIC-based questions for managers to use in pipeline reviews, ensuring consistent coaching.

With a playbook, every rep follows the same rigorous qualification process.

Step 4: Reinforce Through Coaching and Deal Reviews

This step is where implementation succeeds or fails. Without consistent reinforcement, MEDDIC will be forgotten. Deal reviews and coaching sessions are your most powerful tools for making it stick. Managers must stop asking, "What's the update?" and start asking sharp, MEDDIC-focused questions.

For instance, a manager should ask:

"What Metrics have they agreed will justify this purchase?"

"Have we met the Economic Buyer? What is their personal win in this?"

"Who is our Champion, and how have we tested their influence this week?"

This coaching style turns every pipeline review into a strategic session to find and fill qualification gaps. The results can be significant. Some leaders see a 15% quota attainment increase by using analytics to spot weaknesses in Champion development and focusing coaching there. This precision makes complex sales cycles more predictable and can save reps up to 12 hours a week on manual CRM entry.

By following these steps, you can successfully integrate the MEDDIC sales methodology into your sales organization, turning it into a predictable revenue engine.

Using Technology to Reinforce MEDDIC

A sales methodology provides the playbook, but technology makes it work at scale. Manually tracking every MEDDIC detail across dozens of deals is inefficient. Details get lost, and administrative work becomes overwhelming. The right sales tools can turn MEDDIC from a checklist into an automated part of your daily workflow.

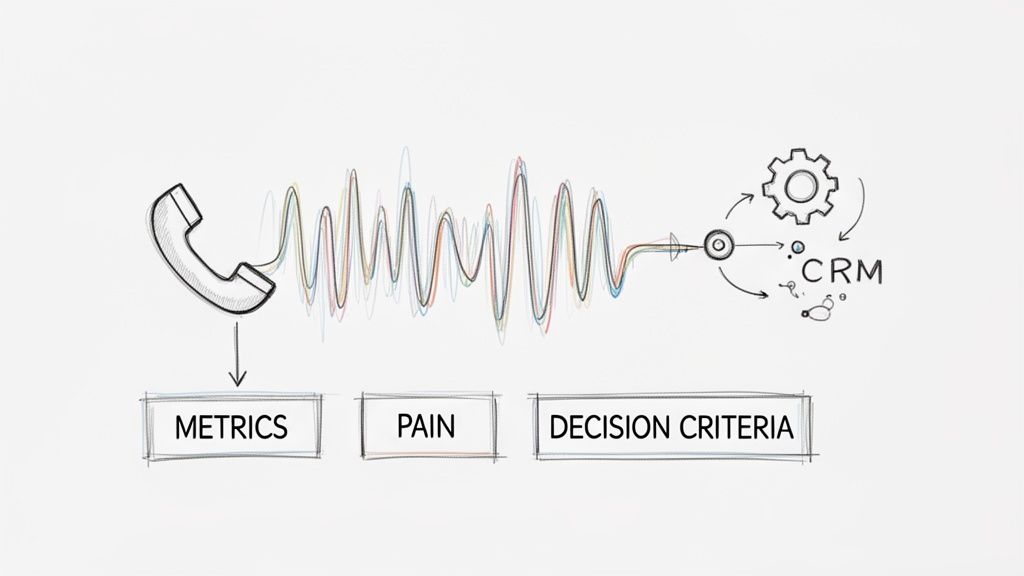

Conversation intelligence tools are a key example. They handle the most tedious parts of the MEDDIC process. They listen to sales calls, automatically identify key details, and push that information directly into your CRM. This eliminates the manual work that prevents reps from keeping deal information current.

Automating Data Capture from Sales Calls

Imagine your rep finishes a discovery call. Instead of spending 30 minutes typing notes into the CRM, the important information is already there. This is what modern technology does.

Tools like Samskit can join your Zoom, Google Meet, or Microsoft Teams calls. They record and transcribe the conversation. Then, they analyze it to extract crucial MEDDIC components without manual effort from the rep.

This creates a seamless flow of intelligence. It ensures your qualification data is always accurate. Critical insights from conversations are never lost, which helps maintain a high-quality MEDDIC process across the team.

Here's how a tool can break down a call transcript to find key MEDDIC elements.

The system automatically flags competitor mentions, pain points, and next steps. It turns a simple conversation into structured, usable data.

From Conversation to CRM Instantly

The real value emerges when this technology connects to your CRM. Identified MEDDIC elements must be organized where they can help you strategize and close deals.

Modern sales tools can automatically populate the correct MEDDIC fields in Salesforce or HubSpot. For example, when a prospect says, "We need to cut our processing time by 20%," the system recognizes that as a Metric and updates the opportunity record.

This automated workflow provides several benefits:

Saves Rep Time: It frees reps from administrative tasks so they can spend more time selling.

Improves Data Accuracy: The CRM reflects what was actually said on the call, not recalled details.

Provides Real-Time Visibility: Sales managers get an immediate, accurate view of deal health across the pipeline.

Automating data entry ensures the MEDDIC framework is applied consistently. Learn more about optimizing your system in our guide to using a CRM for inside sales.

Automating MEDDIC data capture turns your CRM from a database into an intelligence hub. It provides objective, real-time insights for more accurate forecasting and effective coaching.

For teams using tools like Samskit, this integration is powerful. The system can identify Pain points and potential Champions directly from call transcripts. It can automatically update Salesforce with the latest Decision Process stages. This workflow has been shown to boost qualification speed by as much as 35%.

Scaling High-Fidelity Qualification

Technology allows you to operationalize MEDDIC across your entire sales organization. It ensures every rep, from new hires to veterans, follows the same qualification process on every deal.

This consistency separates good sales teams from great ones. When managers trust the data in their CRM, deal reviews become more strategic. Forecasts become more reliable. Coaching can be targeted where it is most needed. Technology provides the foundation for this data-driven culture, turning MEDDIC into a scalable habit instead of an occasional checklist.

Where MEDDIC Implementations Go Wrong

Implementing MEDDIC is one thing; making it stick is another. Even powerful frameworks can fail with poor execution. Many teams stumble over predictable hurdles, turning a revenue engine into a box-ticking exercise.

The most common mistake is treating MEDDIC like an administrative task. Reps fill out CRM fields after a call to satisfy their manager. This misses the point. MEDDIC should be a compass for live conversations, guiding the questions you ask during the call.

Confusing a Coach for a Champion

This is a critical error. It is easy to mistake a friendly contact for a true Champion. A person who gives you information and likes you is a coach. They are helpful, but they are not your Champion.

A real Champion has influence and advocates for you when you are not there. They are personally invested in your success because it solves a problem they care about.

A genuine Champion will stick their neck out for you. If they will not, you have a helpful contact, not a Champion.

How do you tell the difference? Test them. Give your potential Champion a small task that requires action. Ask for an introduction to the Economic Buyer or for a copy of the internal procurement document. If they deliver, you have an advocate. If they hesitate, your search for a real Champion continues.

Accepting Vague Pain Points

Another common pitfall is settling for surface-level pain. A prospect might say, "Our current process is inefficient." That is a start, but it is an inconvenience, not a business problem that justifies a large investment. Vague pain creates no urgency, and deals without urgency stall.

Your job is to make the pain tangible by quantifying it. Connect their problem to business metrics. Dig deeper with questions like:

Financial Impact: "How much revenue are you losing each quarter because of this inefficiency?"

Operational Risk: "What is the consequence if this is not fixed in the next six months?"

Personal Consequences: "How does this issue impact your ability to hit your personal KPIs?"

Pushing for this clarity turns your "nice-to-have" solution into a "must-have" investment. By avoiding these common mistakes, your team can apply the MEDDIC sales methodology with the required rigor, ensuring your implementation delivers predictable results.

Got Questions About MEDDIC? We’ve Got Answers

Implementing a new framework always raises questions. MEDDIC's disciplined approach can feel like a big shift for some sales teams. Let’s address common questions from sales leaders and reps.

How Long Until We See Results?

Every team's timeline is different. Most organizations see tangible improvements in forecast accuracy and deal qualification within the first 90 days. This is the first sign that the team is thinking more critically about its pipeline.

Bigger wins, like increased win rates and shorter sales cycles, typically appear after about six months. By then, MEDDIC is no longer just a checklist. It has become a natural part of how your team thinks, plans, and executes on deals.

Is MEDDIC Just for Huge Enterprise Deals?

MEDDIC excels in complex B2B sales with many stakeholders and high price tags. That is where its rigor provides the most benefit. However, its principles are not exclusive to large deals.

Smaller businesses can benefit from a "MEDDIC-lite" approach. Focusing on just the Economic Buyer, quantifying customer Pain, and understanding Decision Criteria can bring a new level of discipline to your sales efforts, regardless of deal size.

Can We Use MEDDIC with Other Sales Methodologies?

Yes, absolutely. MEDDIC is a qualification framework, not a complete A-to-Z sales system. It works well with other methodologies.

For example, you might use the Challenger Sale model to challenge a customer's thinking and create urgency. That is a great way to open doors. Then, you use MEDDIC to qualify whether that newly created opportunity is real. It provides the structure to ensure you have the access and business case needed to close the deal.

Turn every customer conversation into accurate CRM data and actionable insights. Samskit automatically updates your pipeline, giving your team more time to focus on what matters most—closing deals. Discover how it works at https://samskit.com.